|

The Stacy et al paper, under the auspices of the Institute for Energy research (“IER”), which the IER calls “the IER and ACCCE study”, can be found at: https://www.instituteforenergyresearch.org/wp-content/uploads/2019/06/IER_LCOE2019Final-.pdf Before looking at the paper itself, it’s worth noting that, according to Wikipedia: https://en.wikipedia.org/wiki/Institute_for_Energy_Research “IER is often described as a front group for the fossil fuel industry. It was initially formed by Charles Koch, receives donations from many large companies like Exxon, and publishes a stream of reports and position papers opposing any efforts to control greenhouse gasses.” According to Wikipedia: https://en.wikipedia.org/wiki/American_Coalition_for_Clean_Coal_Electricity “The American Coalition for Clean Coal Electricity (ACCCE, formerly ABEC or Americans for Balanced Energy Choices) is a U.S. non-profit advocacy group representing major American coal producers, utility companies and railroads. The organization seeks to influence public opinion and legislation in favor of coal-generated electricity in the United States.” The degree of independence and intellectual integrity of the paper by Stacy et al, and any analyses and conclusions in it, should be considered in that context. I’ll set out in some detail what Stacy et al say, and then I’ll discuss and assess it critically, which will show some of the deficiencies in their approach, which invalidate their conclusions. The overall conclusion of Stacy et al is: “We find that, in general, absent external non-economic pressures, the most cost-effective generating option is not to replace existing resources.” By “existing resources”, they are generally referring to existing nuclear, coal, oil and gas power stations. Stacy et al says: “If the economic lives of all generation resources matched their assumed financial lives, and no resource ever closed before the end of its economic life, then EIA’s approach would provide enough information to compare the costs of the available options. Contrary to that assumption, the economic lives of existing generation resources exceed EIA’s assumed 30-year financial life… environmental regulations on conventional generators—combined with the wholesale price suppression effect of mandates and subsidies for wind and solar resources and persistent low fuel prices for natural gas—have indeed forced existing coal and nuclear plants to close early.” I note in the above text a claim of “mandates and subsidies for wind and solar resources”. However, these are only described briefly as “wind production tax credit, the solar investment tax credit, and state-level wind and solar mandates”, and there appears to be no mention of subsidies for fossil fuel energy sources, or the externalities they produce that are not currently priced into the energy industry. Both these latter aspects currently provide an unfair and damaging economic advantage to fossil fuels over renewables. Stacy et al suggest two main mechanisms by which they consider existing (mainly FF) energy generation should not be replaced by renewable alternatives:

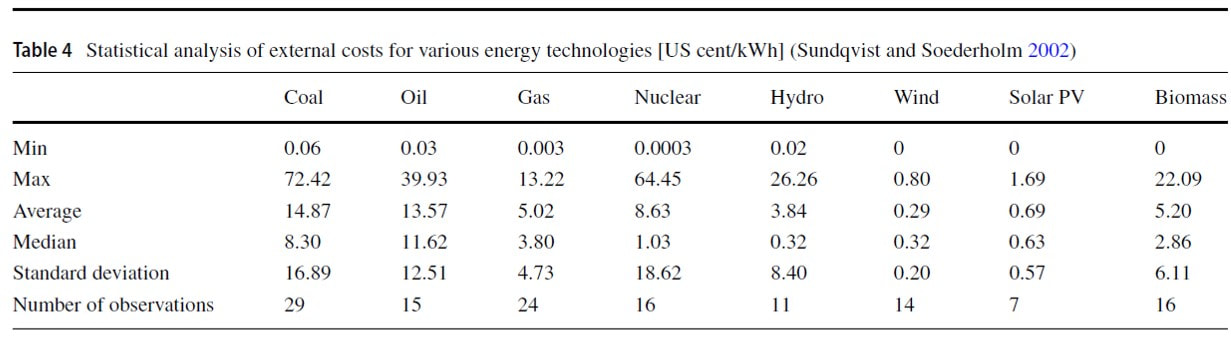

Discussion of point 1 Point 1 conflates costs of construction, costs of fuel and costs of decommissioning, and does not take sufficiently into account all the costs and benefits of the options considered. One of the most significant costs omitted from their analysis is the cost of externalities of fossil fuel energy. One of the most significant benefits omitted from their analysis is the benefit of avoided costs of damage caused by AGW, via GHG emissions from fossil fuels. Point 1 is therefore based on an incomplete analysis. If you make a broader analysis, taking into account all major relevant costs and benefits, it will demonstrate that the claim Stacy et al are making is, at best, very questionable, and at worst, thoroughly misleading and a poor basis for energy policy making. I say more about this below (in a section headed “sunk costs and relevant costs and benefits”). Discussion of point 2 They go on to explain their rationale for point 2 as follows: “Non-dispatchable means that the level of output from wind and solar resources depends on factors beyond our control and cannot be relied upon to follow load fluctuations nor consistently perform during peak loads. Wind and solar resources increase the LCOE of dispatchable resources they cannot replace by reducing their utilization rates without reducing their fixed costs, resulting in a levelized fixed cost increase.” Stacy et al explain what they mean by what they call the “imposed cost” by renewables on the marginal energy production they displace at any particular point in time, which they claim represents a cost through “reducing their utilization rates without reducing their fixed costs, resulting in a levelized fixed cost increase”, and go on to say: “We estimated imposed costs … [if we had the information …] we could determine exactly which resources wind generation displaced each hour, the number of megawatt-hours displaced, and the costs imposed on the displaced resources.” Their main argument seems to be one of minimising cost of capacity utilisation of existing plant through maximising capacity utilisation, and that the capacity utilisation is affected by having alternative generating sources. That sort of approach assumes we only have one type of energy generation plant in a system and are evaluating substituting some of its capacity with an alternative type of energy generation plant. In practice, most countries already have a deliberate overcapacity in an electricity generating system, because the maximum generating capacity has to total more than the periodic and sporadic peak demand load (and, indeed, very exceptionally high peaks). That is done so that there aren’t blackouts at times of exceptional peak demand. At times other than the exceptional peak demand, some generating capacity remains unutilised. So, given this mix of generating plant types, which should be utilised first, next, and so on to the last plant type to be utilised (which will most of the time therefore be underutilised)? One way of looking at this is to build up a stack of generation used at any point in time. It starts with the cheapest energy, until that capacity is fully utilised, then adding the next cheapest, until that capacity is fully utilised, and so on. The most expensive energy might get used only to small capacity utilisation, or not at all. Bielecki (2020) “The Externalities of Energy Production” gives us information about the costs of each energy generation by type of generating technology (from various renewables and fossil fuel energies). For a proper evaluation, this includes externalities such as costs from climate change from the GHG emissions from each energy type, as per the table below.

The table shows that, generally speaking, several renewable energies will be added to the stack I describe above before any of the fossil fuel energies is added. The energies most likely to be under-utilised (the last to be added to the stack, if at all) under this approach are the fossil fuel energies, especially oil and coal, being the most expensive when externalities are taken into account as per Bielecki. The main criticism of Stacy et al's point 2 above is that it relies upon an implicit assumption that reliability of supply to customers is assured through “dispatchable generation” of fossil fuel energy, when in fact much of the energy can be provided from dispatchable renewable energies more cheaply than from fossil fuel energies. With a wide mix of generation technologies and sources, storage, interconnectors, deliberate renewable generation over-capacity, demand-side management and so on, reliability of supply might be assured in different ways in future rather than simply relying on baseload and dispatchable fossil fuel energies as has been done in the past. Indeed, many researchers are now exploring the possibilities of a 100% renewable energy electricity grid, without any fossil fuel energies at all. For example, see the following materials for research into how this can be done: https://web.stanford.edu/group/efmh/jacobson/Articles/I/CountriesWWS.pdf https://cee.stanford.edu/news/100-clean-renewable-energy-and-storage-everything https://web.stanford.edu/group/efmh/jacobson/WWSBook/WWSBook.html?fbclid=IwAR0gK28nT-VEZ7JrtN86_bF03Dww86J53Il3-pWJJMDBlpCEcBeOppV_jWo https://www.sciencedirect.com/science/article/pii/S2542435117300120 Sunk costs and relevant costs and benefits The analysis by Stacy et al does not address two important factors in performing a proper economic and financial evaluation of options for the energy system:

Costs that have already been incurred and cannot be recovered, such as original construction cost of power generating equipment (eg power stations) are sunk costs. In an economic evaluation, sunk costs are excluded because they cannot be affected by the decision to be made on future changes to the system. “Relevant costs / benefits” in this context is a technical term referring to all the future costs and benefits of the various options that are affected by the decision and that are a consequence of the decision going one way versus another. Ideally, all future costs and benefits that are the same in all future options being evaluated should be excluded, to simplify the decision process and improve the clarity of the analysis supporting it. With this concept of relevant costs and benefits in mind, let’s look at a few aspects of the general approach taken by Stacy et al. Stacy et al say “Wind and solar have become popular choices for new energy generation but they are not replacements for required dispatchable capacity on the system”. This is a misleading statement, because renewable energies can (and do) provide dispatchable energy. For example, see: https://www.accenture.com/us-en/blogs/accenture-utilities-blog/the-potential-and-allure-of-more-dispatchable-renewables and: http://www.dispatchablerenewables.entura.com/dispatchable-renewables-for-reliable-affordable-sustainable-power/ from which: “Effectively, baseload [and dispatchable] fossil fuel generation can be replaced by the combination of variable renewables, dispatchable renewables, change in use of existing hydropower, and smart high-voltage network support and planning to ensure sufficient transmission capacity.” Who should bear the costs of transitioning to a decarbonised energy system? The world knows that, because of AGW, there needs to be a transition from the old hub-and-spoke energy system, mainly built around large central (baseload and dispatchable) fossil fuel power stations, to a decarbonised energy system, based around a wider mix, size and geographical spread of multiple energy generation technologies, interconnectors, load-balancing and demand management mechanisms, with a lot more localised or regionalised energy generation. Stacy et al seem to suggest that the “costs” of changing that infrastructure model (eg in relation to the supposed need to rely on “dispatchable” sources) representing a cost of introducing the newer energy generation plant, substituting for existing fossil fuel plant, as being an unfair impact by increasing the comparative LCOE (Levelised Cost of Energy) of the fossil fuel plant. However, the cost of changing the infrastructure model from the existing energy generation plant and infrastructure is is a relevant cost, because it is a future cost. And one benefit of attributing infrastructure transition costs to existing fossil fuel plant and infrastructure is that it would accelerate the transition, potentially reducing the total costs of damage arising from AGW, and the costs of responding to AGW with mitigation and adaptation activities. The benefits obtained (including reduced damage and reduced other costs relating to AGW) are a relevant benefit, because they are future benefits derived from the decision. Care would need to be taken to assess whether such attribution of costs would lead to economically optimal transition pathways. One mechanism for achieving optimal economic pathways is carbon taxes or other carbon pricing mechanisms, because these mechanisms price in the externalities (including damage from AGW) and then leave it to market forces to find the optimal transition pathway. Such carbon taxes etc, as well as being economically optimal, are one way of also achieving a moral objective, which I’ll now explain. The information from Bielecki that I included earlier in this article is an example of estimates of the impacts of including the costs of externalities on the cost of each energy generation technology. One moral justification for taking the above approach (of putting the financial burden for transition onto existing fossil fuel generating plant and infrastructure) is that it was the existing fossil fuel energy generating plant that caused the majority of AGW, necessitating the transition to a decarbonised energy system and economy, so it is only fair that such plant should bear the financial burden of transitioning to a decarbonised system. However, as I say, that is a moral case rather than an economic one. In summary, on both an economic case, and also a moral one, the conclusions made by Stacy et al are based on flawed analyses and assumptions and do not form a sound basis for energy policy making.

0 Comments

Leave a Reply. |

AuthorThe Planetary CFO - working towards a sustainable World Balance Sheet. Categories

All

Archives

July 2024

|