|

I participated in an A4S webinar yesterday on "Measure What Matters: Capitals Accounting". It was an excellent opportunity to engage with a network of CFOs on some of the big issues relevant to accounting and sustainability.

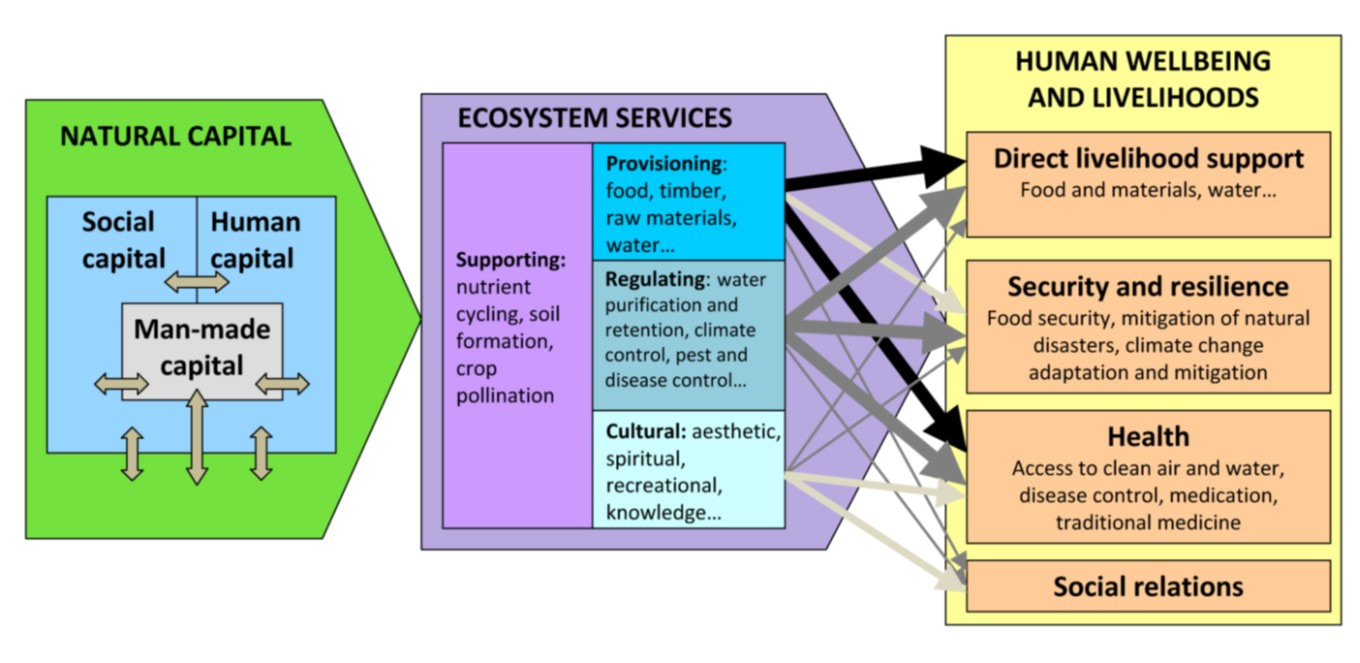

One of the discussion points was about substitutability of capitals, and, in particular, whether Natural Capital should be substitutable for other forms of capital. For context, the diagram above is from TEEB (2018) "Measuring what matters in agricultural food systems". The diagram was adapted by the authors of TEEB (2018) from an original source, which was the Millennium Ecosystem Assessment 2005 Synthesis Report. The general view from the webinar leaders/panelists, including a representative from TEEB, was that Natural Capital should not be substitutable for other types of capital. Full stop. No ifs, no buts. Natural Capital should be maintained (even enhanced) and not converted into other types of capital (for example, produced capital or financial capital). This draws on (and is almost a definition of) a concept of Strong Sustainability, rather than Weak Sustainability. Strong Sustainability is a concept I support, as a suitable response to the mounting evidence that generations of people have not just neglected but caused massive amounts of destruction and degradation to Natural Capital around the world, pushing us far into ecological overshoot, as highlighted very graphically by Earth Overshoot Day. It also means that individual businesses, as well as all other types of organisation, when assessing their impacts and dependencies, should carefully and separately identify the distinctions between the goods and services which Natural Capital provides as inputs to their business models, as distinct from the Natural Capital which provides them. (This is something that many organisations have been woefully poor at doing throughout modern history). They must not degrade or deplete the Natural Capital, for example by causing goods and services drawn from Natural Capital sources to exceed that which can sustainably be produced by that Natural Capital in perpetuity. Also, they must not allow their business processes to cause more carbon emissions, other waste or damage than can be sustainably accommodated by the Natural Capital in perpetuity. At an aggregate global level, the development of a World Balance Sheet will help us to assess whether the combined activities and impacts of all organisations, whether businesses or not, are complying with these requirements. The whole of the world's Natural Capital will be a key component of the World Balance Sheet. See more about the World Balance Sheet concept in my previous blog posts and at WorldBalanceSheet.com. On that site, I list my recent books, published this year, which go into more details about the emergence of the World Balance Sheet concept. These are very early days for the World Balance Sheet, but my hope is that we will rapidly reach the point where it will tell us whether enough people are practising Strong Sustainability to make a real difference in the transition to a just and sustainable future for the whole global population, today and in perpetuity.

0 Comments

Leave a Reply. |

AuthorThe Planetary CFO - working towards a sustainable World Balance Sheet. Categories

All

Archives

July 2024

|